Statement charges are useful if you want to accumulate charges before requesting payment, or if you assess a regular monthly charge to your customer. Use statement charges when you are not going to be providing the customer with an invoice, but instead will provide the customer with a periodic statement.

Recording statement charges one customer at a time can be very time consuming. If this charge is recurring, consider adding them to a Memorized Transaction Group.

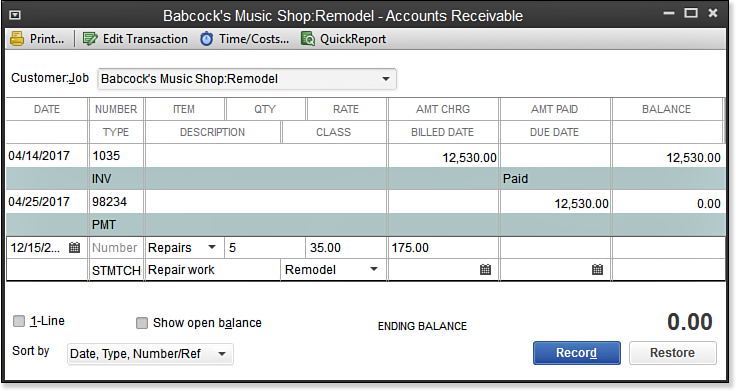

Recording a Statement Charge

To practice recording a statement charge, open the sample data file as instructed in Chapter 1 of Laura Madeira’s QuickBooks 2013 In Depth:

- On the Home page, click the Statement Charges icon.

- In the Customer:Job drop-down list, select the Babcock’s Music Shop:Remodel job. See below:

- For this exercise, place your cursor in the next available row and accept the prefilled date. The selected customer’s Accounts Receivable register displays.

- Leave the Number field blank. In the Item field, type Repairs.

- In the Qty field, type 5.

- In the Class field, type Remodel.

- Click Record to save the charge on the customer’s register. Repeat steps 2–7 as needed to add additional statement charges.

From Laura Madeira’s QuickBooks 2013 In Depth