Did you know that you can “lock” your QuickBooks data and prevent users from making changes to prior accounting periods? This process is what we accountants call a “soft close.” This means that at any time, if you do need to add or modify a transaction in a prior period, the Admin user (or someone with security rights) can return and “unlock” the accounting period.

To have QuickBooks track information for the Closing Date Exception report, you first have to set a closing date and optionally set specific users’ access to adding or modifying transactions on or before this date.

–> A word of caution: Exceptions, additions, and changes are not tracked unless a closing date has been set for a QuickBooks file.

If you have compared your own or your clients’ data to prior year financials or tax returns and the ending balances prior to the closing date have changed, you should view the Closing Date Exception report to see exactly who made the change and what specific transactions were affected. For more information on working with clients’ files, see Chapter 16 of Laura Madeira’s QuickBooks 2013 In Depth titled: “Sharing QuickBooks Data with Your Accountant.”

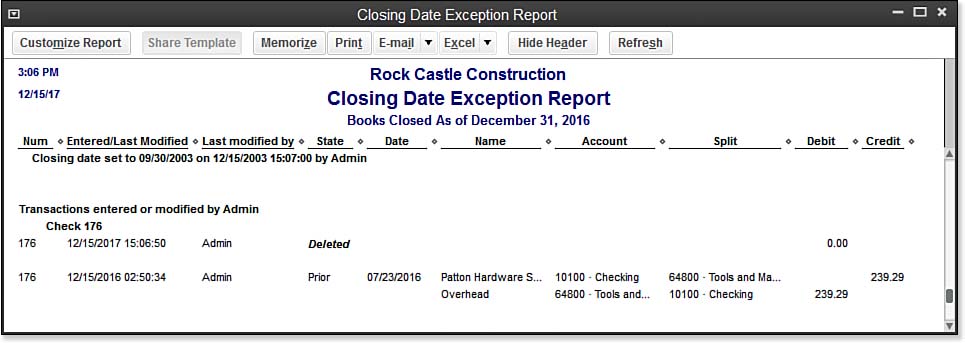

To create the Closing Date Exception report (see image below) from the menu bar, select Reports, Accountant & Taxes, Closing Date Exception. If you have not set a closing date, a warning prompt will display.

Review the Closing Date Exception Report for changes made to transactions dated on or before a closing date.

This report enables you to identify changes that were made to transactions dated on or before the closing date. For modified transactions, the report details both the latest version of a transaction and the prior version (as of the closing date). If your QuickBooks access rights allow you to change closed period transactions, you can then re-create the original transaction or change the date of added transactions, so you can again agree with the ending balance from the previously closed period.

For accounting professionals, see Appendix A in QuickBooks 2013 In Depth titled “Client Data Review,” for details on using the Troubleshoot Beginning Balances feature in QuickBooks Accountant.