How to Reconcile a Bank or Credit Card Account in QuickBooks

by Laura Madeira | November 8, 2013 9:00 am

Are you reconciling your bank or credit accounts in QuickBooks? If the answer is no, are you reconciling these accounts on the monthly paper statement provided by the financial institution? If you still answered no, you will certainly find value in learning how easy it is to reconcile these accounts in QuickBooks.

Why exactly is it so important? Most businesses record a significant amount of income and expenses through bank or credit card activity. When the reconciliation is not completed in the software, how certain are you that the financial reports are accurate? There are a few exceptions to income and expenses flowing through a bank account. For example, a restaurant or bar might manage a significant amount of cash during the course of doing business. Do not limit yourself to thinking the task of reconciling is limited to bank or credit card accounts. If you have a cash safe, drawer, or box at the office, reconcile the ins and outs of the cash in your QuickBooks data.

–> Note: If your work is interrupted while you are reconciling a bank or credit card statement, you can click Leave in the Reconcile–Account dialog box. Clicking Leave will keep the check-marks you have assigned to transactions, and let you return to finish your work later.

To begin reconciling your bank or credit card accounts, follow these steps:

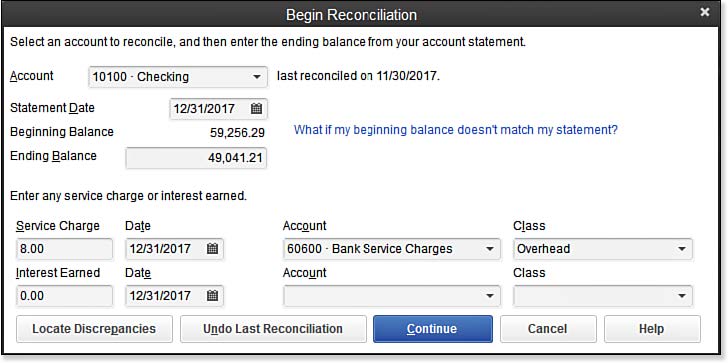

- From the menu bar, select Banking, Reconcile to open the Begin Reconciliation dialog box, as shown here:

[1]

[1]Reconcile your accounting records to your financial institution’s monthly statement.

- From the Account drop-down list, select the appropriate account. (Any Balance Sheet type account can be reconciled.)

- Select the Statement Date that matches the ending statement date from your financial institution.

- Review the Beginning Balance, which should equal the same number provided by your financial institution.

–> Note: Where does the beginning balance originate from on the Begin Reconciliation dialog box? It is the sum total of all previous transactions for the selected account that are marked as cleared.

- Enter the ending balance from your financial institution’s period statement.

- (Optional) Enter any Service Charge or Interest Earned, selecting the appropriate date, account, and Class if tracking the use of Classes.

- Click Continue. The Reconcile– Account Name dialog box opens.

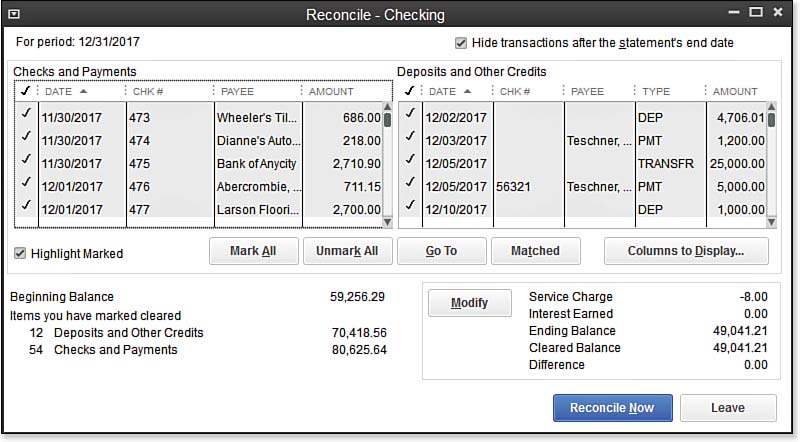

- Place a check-mark in the Hide Transactions After the Statement’s End Date. This makes the task of reconciling much easier.

- Place individual check-marks next to each cleared Checks and Payments and Deposits and Other Credits that are included in the statement from your financial institution.

- Click Reconcile Now only when the Difference is 0.00, as shown below. This indicates that your cleared transactions match those provided by the financial institution.

[2]

[2]Reconcile your QuickBooks transactions to your financial institution’s for a specific month.

–> For more information, see “Reconciling with an Adjustment,” p. 525 of Laura Madeira’s QuickBooks 2013 In Depth[3].

- Follow the prompts to print the reconciliation report to attach to your financial institution’s statement for safekeeping.

Other useful features of working with the Reconcile feature in QuickBooks include the following:

- Highlight Marked—Make it easier to differentiate the cleared from the noncleared transactions on the computer screen.

- Mark All or Unmark All—Use to automatically add or remove check-marks from transactions during the bank reconciliation process.

- Go To—Open the currently selected transaction. Useful if you need to modify the transaction.

- Matched—Match downloaded transactions to the transactions in QuickBooks.

- Columns to Display—Add or remove the columns of data displayed.

- Modify—Click to change the reconcile For Period date or the Ending Balance amount.

- Leave—Click to save your work and close the Begin Reconcile window.

You can also click any column header to sort the data in that column.

Reconciliations are easiest when done each month. However, you might have been using QuickBooks for some time before learning how to complete the reconciliation task. See the section of QuickBooks 2013 In Depth titled “Troubleshooting Reconciliations,” to help you learn how to troubleshoot the first reconciliation, or fix errors in previous reconciliations.

- [Image]: http://www.quick-training.com/wp-content/uploads/2013/11/13.18.jpg

- [Image]: http://www.quick-training.com/wp-content/uploads/2013/11/13.19.jpg

- QuickBooks 2013 In Depth: http://www.quick-training.com/quickbooks-2013-in-depth/

Source URL: http://www.quick-training.info/2013/11/08/how-to-reconcile-a-bank-or-credit-card-account-in-quickbooks/