Use a QuickBooks estimate to provide prospects a quote for your product or services. The estimate helps you keep track of the sales price you have quoted. In accounting terms, the estimate is considered “nonposting,” which means when you record an estimate you are not yet recording revenue.

Estimates also provide the means for QuickBooks to prepare a budget (expected costs and revenue) for a customer or job. There are many job costing reports that use the estimate details. You can view these reports using a sample data file. From the Reports menu, select Jobs, Time & Mileage, and view the Job Estimates vs. Actuals Summary or Detail (to name just a couple).

To practice creating a new estimate, open the sample data file. If you are using your own data file, make sure you have enabled estimates:

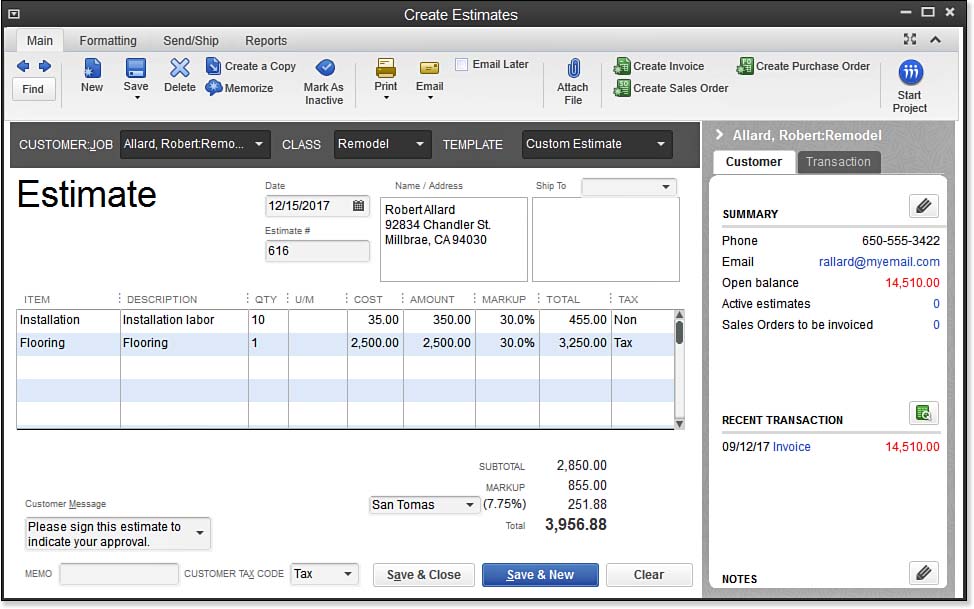

- On the Home page, click the Estimates icon. The Create Estimates transaction displays, as shown here:

- In the Customer:Job drop-down list, select the customer Allard, Robert:Remodel job.

- For this exercise, leave the prefilled values in the Template, Date, Estimate #, and Name/Address fields.

- Click the first field in the Item column and use Installation. Accept the prefilled description of Installation Labor.

- In the Qty field, type 10.

- Leave the U/M (Unit of Measure) field blank.

- Accept the Cost field default of $35.00.

- In the Markup field, type 30%. (See the caution that follows below.) Accept the default Tax line assignment.

- In the Item column on the next available row, select the non-inventory part, Flooring.

- In the Qty field, type 1. Leave the U/M (Unit of Measure) field blank.

- In the Cost field, type 2,500.00.

- In the Markup field, type 30%. Accept the default Tax line assignment.

- Click Save & Close to complete the estimate, or click Save & New to practice creating another estimate.

–> A word of caution: When working with Estimates, if you want the markup to be % over cost, you must also type the percentage (%) character. To charge a fixed dollar amount over cost, type the dollar amount. If you do not include anything in the Markup column, QuickBooks job budget vs. cost reports will consider the amount in the Cost column the same as the Total, which is, in effect, the Sales Price. Best practice is to include a markup % or dollar amount.

You now have an estimate and can track quotes you provide to your prospects. When your prospect becomes a customer, create the invoice from the estimate.

Estimates can also be used to create Sales Orders. See Chapter 9 of Laura Madeira’s QuickBooks 2013 In Depth for more details.

–> Here’s another tip: Do you need to track Active vs. Inactive Estimates? From the Ribbon Toolbar on the Create Estimates dialog box, select the Main tab and toggle the checkmark on or off for Mark as Active or Mark as Inactive. When an Estimate is inactive, it will not display on drop-down lists.